- Cuba says inflationary pressures and geopolitical uncertainty could make Bitcoin a global reserve currency

- The Billionaire Thinks Trump’s Lower Taxes and Tariffs Could Drive Bitcoin Prices Higher

- Elon Musk plans to spend $45 a month to support Trump’s presidential campaign

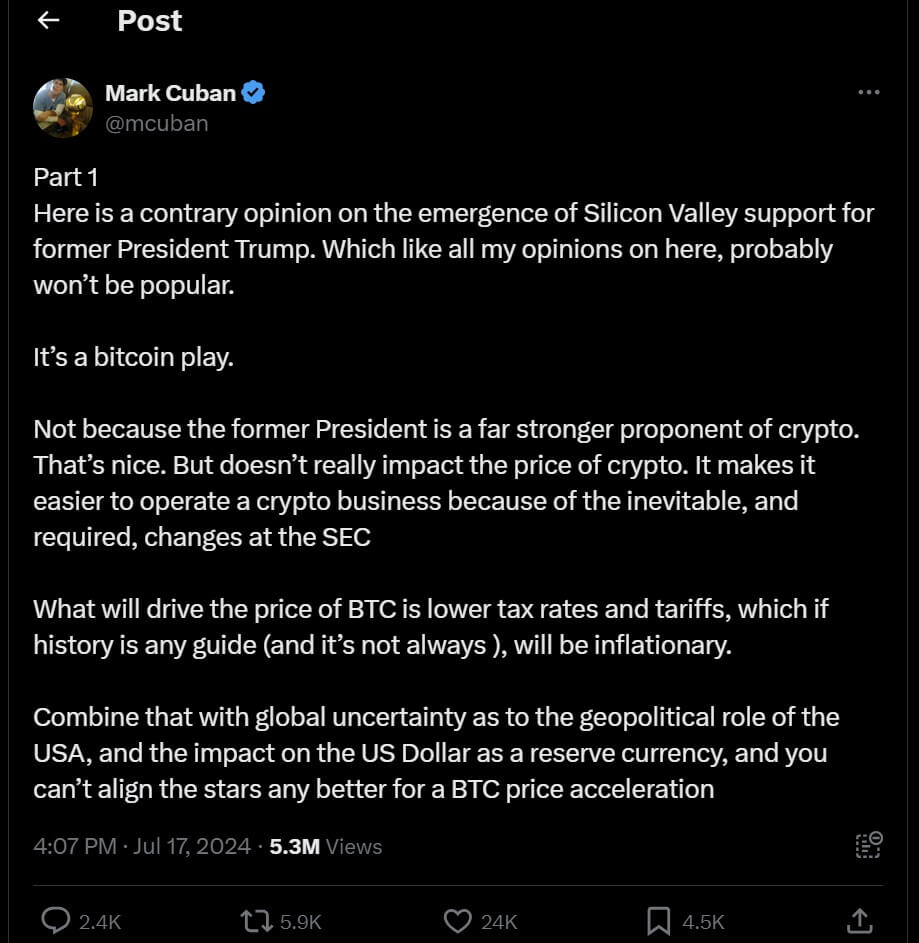

American billionaire Mark Cuban believes that Bitcoin could become a global reserve currency due to a combination of inflationary pressures and geopolitical uncertainty.

The billionaire said in an interview with The Cuban, who supports Joe Biden’s re-election, said lower taxes and tariffs under Trump could push the price of Bitcoin higher.

“Add to this global uncertainty about the U.S.’s geopolitical role, and the impact of the U.S. dollar as a reserve currency, and you couldn’t be better positioned for Bitcoin price acceleration,” Cuban wrote.

He added that this would make it “easier for crypto businesses to operate as the SEC inevitably makes necessary changes.”

The Potential of Bitcoin as a Global Reserve Currency

Questioning how high Bitcoin could go, Cuban didn’t give a specific number but wrote it was “much higher than you think,” adding that this was due to its global status, a cap of 21 million Bitcoins and the fact that the currency has infinite fragmentation.

Cuban believes that if geopolitical uncertainty persists and the U.S. dollar’s status as a reserve currency declines, Bitcoin may become a safe haven as countries seek to protect their savings and thus turn to Bitcoin.

Factors Influencing Bitcoin’s Future

Transitioning to a discussion on the factors influencing Bitcoin’s future, Cuban highlights the importance of global uncertainty, the U.S. dollar’s role, and potential changes in regulations that could impact the cryptocurrency market.

He emphasizes the need for a deeper understanding of how Bitcoin’s value could be affected by geopolitical shifts and economic changes on a global scale.

Bitcoin and Geopolitical Trends

Exploring the relationship between Bitcoin and geopolitical trends, Cuban suggests that Bitcoin’s value could see significant growth if countries start adopting it as a hedge against inflation and political instability.

He points out that while the idea of Bitcoin becoming a global reserve currency is speculative, there are already observable trends in countries experiencing hyperinflation.